We can give you a

smooth transition into retirement.

Retirement: Centrelink explained

What is the Age Pension?

The purpose of the Age Pension is to make sure you have enough income in retirement. It is a fortnightly payment made by the government to help you meet the cost of living, if your retirement savings are below a certain level.

To be eligible for the Age Pension, you must have reached a certain age. If you satisfy the age criteria, your current level of wealth is then assessed to determine whether you can receive a payment.

You are also assessed based on whether:

- you are single or a member of a couple, and

- you own your own home.

Transitional rules

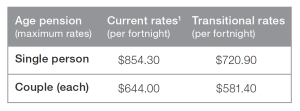

The Australian pension system is undergoing reform. To ensure that no pensioner is worse off under the new reform rules*, two sets of payment rates are being used:

- the current rate, and

- the transitional rate.

We can help you find out which rate applies to you. If you are eligible for the Age Pension, you will receive a fortnightly payment up to the maximum pension.

1 Rates include pension supplement of $63.50 for singles and $47.90 for couples (each).

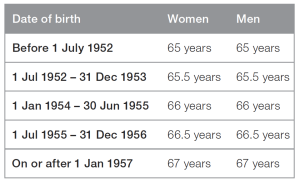

When can you apply for the Age Pension?

The qualifying age# depends on when you were born, as set out in the table below.

How are you assessed?

Once you reach the qualifying age, your current wealth (your assets and your income) is measured to determine your eligibility. To receive a payment, you must meet both an asset and an income test. Both tests are applied to your circumstances, and the test that results in the lowest payment is used.

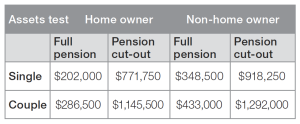

The assets test

If the value of your assets is below the minimum level, you qualify for a full pension. If your assets are above the top level, you will not receive a payment. If the value of your assets falls between these two levels, you will receive a part pension.

If you qualify for a part pension, the maximum rate of pension is reduced by $1.50 per fortnight for every $1,000 of assets over the minimum level.

Gifting assets

To prevent people from giving money and assets away to their family, friends or charities for the sole purpose of increasing their Centrelink benefits, special gifting rules apply. In one financial year, you can give away assets up to the value of $10,000 without affecting your Centrelink payment. You can only give away a total of $30,000 over a rolling five year period.

Any amounts that you gift above these limits are treated as an assessable asset and included in the assets test. Income that would have been earned from the asset will also be assessed under the deeming rules. The asset and income values calculated remain in force for five years.

The gifting rules do not apply if you are selling an asset and receive equal consideration in return.

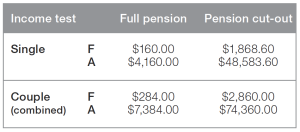

The income test

The income test works in a similar way to the assets test. Your income must fall below a certain level to receive a full pension, or between two levels to receive a part pension.

For every dollar that your income is above the full pension level, your Age Pension will be reduced by 50 cents as a single, or 25 cents as a member of a couple.^ If you are a member of a couple, your income is combined with your partner’s to determine your eligibility. Your income under the income test is not measured simply on the amount of income you receive. Special rules apply.

F – per fortnight A – per annum

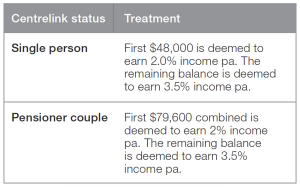

What are deeming rates?

To help Centrelink gain a complete picture of your income from all sources, your financial investments are generally assessed under a single set of rules. This is known as deeming. Rather than use the actual income you receive, Centrelink uses an assumed rate of income and applies this to your financial investments.

Special treatment of superannuation savings

To encourage you to save for your retirement, Centrelink treats your superannuation savings differently to your other financial assets. Until you reach Age Pension age, your superannuation savings are not counted when determining how much money you will receive from Centrelink.

Once you reach Age Pension age, the full value of your superannuation savings is counted under the assets test. If you have not used your superannuation savings to start a retirement income stream, your superannuation savings are also deemed under the income test.

What is the Work Bonus?

To encourage people eligible for the Age Pension to continue to work, the Government has introduced the Work Bonus. It applies to all pensioners who are over Age Pension age and being assessed under the new rules. The bonus allows concessional treatment of your employment income when you are being assessed under the income test for the Age Pension.

Putting it all together

Centrelink uses a set of tests, including the income test and the assets test, to assess your wealth and make sure that you receive the right amount of money from the government in the form of the Age Pension. Other rules, such as deeming rates and the Work Bonus, may impact your pension payments.

We can help you navigate the rules that Centrelink uses to calculate your financial situation, and structure a financial strategy that will provide the right amount of income to maintain your lifestyle into retirement.